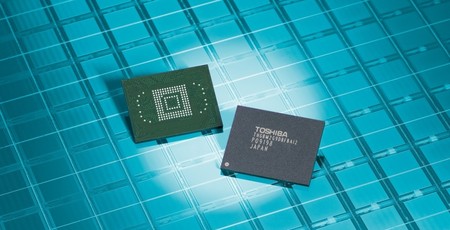

Toshiba's semiconductor spin-off, Toshiba Memory Corporation, may be coming back in-house with a report claiming the company is to buy back its shares from Apple, Dell, Kingston, and Seagate.

Toshiba announced its plan to raise funds by spinning off the bulk of its semiconductor business back in January 2017 after an attempt to break into the US nuclear energy market left the company in the red. While earlier rumours had suggested that Western Digital was the frontrunner for picking up the shares in what would be called the Toshiba Memory Corporation, other bidders soon entered the ring - leading to attempts by Western Digital to block the deal altogether. When Toshiba confirmed Western Digital's bid was unsuccessful it triggered lawsuits and arguments before an agreement was reached.

Now, Toshiba Memory Corproration is reportedly looking to buy back some of its shares at a considerable loss - thanks to funding supplied by Japanese banks ahead of a a planned initial public offering (IPO).

According to sources speaking to The Wall Street Journal, Toshiba Memory Corporation is looking to buy back the shares currently owned by Apple, Dell, Kingston, and Seagate as part of the Bain Capital consortium. Said companies would be offered a value above the original purchase price, representing profit estimated at hundreds of millions of dollars - profit which comes directly at Toshiba Memory Corporation's expense.

Thus far, none of the named companies have come forward to confirm nor deny the report.

MSI MPG Velox 100R Chassis Review

October 14 2021 | 15:04

Want to comment? Please log in.