Nvidia has bucked the current PC market slowdown, posting boosted profits compared to the same time last year thanks to strong sales of its high-end Kepler-based GPU products.

According to the company's quarterly filing report, the company made an impressive $954.7 million in the first quarter of its financial year 2014 - and while that's down a disappointing 13.7 per cent compared to the last quarter of FY13, when the company took in a whopping $1.11 billion, it represents a 3.2 per cent gain on the same period last year. With other PC-related companies complaining of slowing sales and tight margins, that's not too shabby at all - and comes at the very top of the company's previous projections.

'Our results this quarter came in at the upper end of our guidance, driven by strong sales of higher-end GPU products for PC gaming,' explained Nvidia's Rob Csongor, vice president of investor relations, during the company's conference call late last night. 'We made good progress on our key strategies as the Kepler GPU architecture, which delivers outstanding performance and energy efficiency drove strong GeForce demand with PC gamers and began to flow through our Quadro and Tesla businesses in new products.'

Keplar on the rise

Increased uptake of high-priced Kepler boards, especially in the workstation market, have seen the company's margins rise to a record 54 per cent - 1.4 points up on the last quarter, and 4.2 per cent year-on-year. 'There are always puts and takes but this improvement reflects our richer mix of higher margin products as well as the underlying value of our GPUs in the marketplace and our focus on cost,' claimed Burns. 'For Q2, we expect margins to remain within the same 54% range as Q1 with a high mix of our higher margin products.'

Another major win for the company has been uptake of GeForce Grid, the company's GPU-powered cloud computing platform, and its closely-aligned workstation-centric Grid Visual Computing Appliance (VCA). 'In the short time since we began taking Grid to market this quarter, we've engaged over 100 Grid VGX and Grid VCA trial customers and signed many of the top Adobe, Autodesk and SolidWorks resellers to take Grid VCA to market,' claimed Csongor. 'We believe Grid VCA represent a potential $3 billion market opportunity.'

Discussing the slowing PC market and growth of tablets, Nvidia's co-founder, chief executive and president Jen-Hsun Huang was bullish on his company's future in the discrete GPU market. ' People who build high-end gaming PCs, and people who are enthusiasts, and who enjoy having the most performance on the desktop, or people who are building these PCs for their own video editing hobbies, or the maker people who are designing 3D objects and then printing it at home, they print their own jewellery, they print their own, I don't know what, telephones: they need to be designing 3D somehow, and those PCs tend to have GPUs inside,' explained Huang. 'And that's a movement that's really growing fast. So, I would say that desktop PC market that we target, that we serve, is quite a vibrant market.'

An admission from Huang of just how high the margins on his company's enterprise-grade products are - the Grid family and the Tesla GPGPU accelerator boards - provides a glimpse as to the headline-grabbing 54 per cent profit margin: 'Grid and Tesla are much higher than 54 per cent,' Huang explained, '[while] Tegra is lower than 54 per cent. Whenever our gaming business improves, it helps gross margins. Whenever GTX improves, it helps gross margins. When Tesla grows, it helps gross margins. Notebooks obviously drag the gross margins down, because they tend to be a more competitive business. Low-end desktop PC business tends to drag gross margins, but that's not a very large business [for Nvidia] anyhow.'

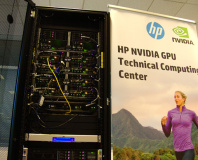

'You know, the PC market declined 10 per cent quarter-over-quarter, but we declined only 6 per cent quarter-over-quarter,'' added Csongor. 'That difference comes from growth in the non-commodity PC space. Non-commodity PC space will tend to be Tesla and Quadro and GTX, and those growths are always good for us and that helps gross margins. That's also where we are putting most of our energy. Most of our energy related to GPGPU, related to extending our GPU beyond the PC into our datacentres and servers all the work that has led to the announcement of Cisco, and IBM, and Dell and HP launching their GPU servers, all of that kind of growth is good and I think we are just gearing up for Grid becoming a larger and larger component of our business - and that's good for our margins.'

Tough time for Tegra

But what of Tegra, the company's ARM-powered system-on-chip product? Back in November, the company claimed that a large proportion of its growth was coming from non-PC products, meaning Tegra and its related chipsets. Well, things appear to be slowing down a little on that front - the company has reported a 50.5 per cent dip in revenue sequentially, and 22.2 per cent year-on-year - likely as a result of increased competition from the like of Qualcomm's popular Snapdragon family and as the market waits for the first Tegra 4 products to hit shop shelves - due, Csongor claimed, during the next financial quarter.

'Sales volume of Tegra 3 processors declined as customers began to ramp down production of Tegra 3 base mark phones and tablets,' admitted Karen Burns, the company's interim chief financial officer and vice president, during the call. 'We expect this to continue in to the next quarter as customers start to announce Tegra 4 design with further new designs and phone ramp starting in the second half of the year.'

Beyond a commitment to launch Tegra 4 into the market - or at least have some of its customers announce devices powered by the chip, and its Tegra 4i LTE-modem integrated variant - by the end of the next quarter, Nvidia was silent on impending product launches, except to say that it expects an uptick in sales when Intel launches its Haswell processor family at Computex in June.

For those who like full figures: the company's Generally Accepted Accounting Practices (GAAP) revenue for the quarter was $954.7 million on a gross margin of 54.3 per cent. With operating expenses for the quarter totalling $435.8 million, that makes for a total net profit for the quarter of $77.9 million - or $0.13 per share. Investors appear to have taken the news cautiously: despite hitting the top end of its projections, Nvidia's stock price is steady having climbed just 1.01 per cent in after-hours trading.

According to the company's quarterly filing report, the company made an impressive $954.7 million in the first quarter of its financial year 2014 - and while that's down a disappointing 13.7 per cent compared to the last quarter of FY13, when the company took in a whopping $1.11 billion, it represents a 3.2 per cent gain on the same period last year. With other PC-related companies complaining of slowing sales and tight margins, that's not too shabby at all - and comes at the very top of the company's previous projections.

'Our results this quarter came in at the upper end of our guidance, driven by strong sales of higher-end GPU products for PC gaming,' explained Nvidia's Rob Csongor, vice president of investor relations, during the company's conference call late last night. 'We made good progress on our key strategies as the Kepler GPU architecture, which delivers outstanding performance and energy efficiency drove strong GeForce demand with PC gamers and began to flow through our Quadro and Tesla businesses in new products.'

Keplar on the rise

Increased uptake of high-priced Kepler boards, especially in the workstation market, have seen the company's margins rise to a record 54 per cent - 1.4 points up on the last quarter, and 4.2 per cent year-on-year. 'There are always puts and takes but this improvement reflects our richer mix of higher margin products as well as the underlying value of our GPUs in the marketplace and our focus on cost,' claimed Burns. 'For Q2, we expect margins to remain within the same 54% range as Q1 with a high mix of our higher margin products.'

Another major win for the company has been uptake of GeForce Grid, the company's GPU-powered cloud computing platform, and its closely-aligned workstation-centric Grid Visual Computing Appliance (VCA). 'In the short time since we began taking Grid to market this quarter, we've engaged over 100 Grid VGX and Grid VCA trial customers and signed many of the top Adobe, Autodesk and SolidWorks resellers to take Grid VCA to market,' claimed Csongor. 'We believe Grid VCA represent a potential $3 billion market opportunity.'

Discussing the slowing PC market and growth of tablets, Nvidia's co-founder, chief executive and president Jen-Hsun Huang was bullish on his company's future in the discrete GPU market. ' People who build high-end gaming PCs, and people who are enthusiasts, and who enjoy having the most performance on the desktop, or people who are building these PCs for their own video editing hobbies, or the maker people who are designing 3D objects and then printing it at home, they print their own jewellery, they print their own, I don't know what, telephones: they need to be designing 3D somehow, and those PCs tend to have GPUs inside,' explained Huang. 'And that's a movement that's really growing fast. So, I would say that desktop PC market that we target, that we serve, is quite a vibrant market.'

An admission from Huang of just how high the margins on his company's enterprise-grade products are - the Grid family and the Tesla GPGPU accelerator boards - provides a glimpse as to the headline-grabbing 54 per cent profit margin: 'Grid and Tesla are much higher than 54 per cent,' Huang explained, '[while] Tegra is lower than 54 per cent. Whenever our gaming business improves, it helps gross margins. Whenever GTX improves, it helps gross margins. When Tesla grows, it helps gross margins. Notebooks obviously drag the gross margins down, because they tend to be a more competitive business. Low-end desktop PC business tends to drag gross margins, but that's not a very large business [for Nvidia] anyhow.'

'You know, the PC market declined 10 per cent quarter-over-quarter, but we declined only 6 per cent quarter-over-quarter,'' added Csongor. 'That difference comes from growth in the non-commodity PC space. Non-commodity PC space will tend to be Tesla and Quadro and GTX, and those growths are always good for us and that helps gross margins. That's also where we are putting most of our energy. Most of our energy related to GPGPU, related to extending our GPU beyond the PC into our datacentres and servers all the work that has led to the announcement of Cisco, and IBM, and Dell and HP launching their GPU servers, all of that kind of growth is good and I think we are just gearing up for Grid becoming a larger and larger component of our business - and that's good for our margins.'

Tough time for Tegra

But what of Tegra, the company's ARM-powered system-on-chip product? Back in November, the company claimed that a large proportion of its growth was coming from non-PC products, meaning Tegra and its related chipsets. Well, things appear to be slowing down a little on that front - the company has reported a 50.5 per cent dip in revenue sequentially, and 22.2 per cent year-on-year - likely as a result of increased competition from the like of Qualcomm's popular Snapdragon family and as the market waits for the first Tegra 4 products to hit shop shelves - due, Csongor claimed, during the next financial quarter.

'Sales volume of Tegra 3 processors declined as customers began to ramp down production of Tegra 3 base mark phones and tablets,' admitted Karen Burns, the company's interim chief financial officer and vice president, during the call. 'We expect this to continue in to the next quarter as customers start to announce Tegra 4 design with further new designs and phone ramp starting in the second half of the year.'

Beyond a commitment to launch Tegra 4 into the market - or at least have some of its customers announce devices powered by the chip, and its Tegra 4i LTE-modem integrated variant - by the end of the next quarter, Nvidia was silent on impending product launches, except to say that it expects an uptick in sales when Intel launches its Haswell processor family at Computex in June.

For those who like full figures: the company's Generally Accepted Accounting Practices (GAAP) revenue for the quarter was $954.7 million on a gross margin of 54.3 per cent. With operating expenses for the quarter totalling $435.8 million, that makes for a total net profit for the quarter of $77.9 million - or $0.13 per share. Investors appear to have taken the news cautiously: despite hitting the top end of its projections, Nvidia's stock price is steady having climbed just 1.01 per cent in after-hours trading.

MSI MPG Velox 100R Chassis Review

October 14 2021 | 15:04

Want to comment? Please log in.