Lattice Semiconductor acquired by Canyon Bridge group

November 4, 2016 | 10:26

Companies: #canyon-bridge #lattice-semiconductor

The semiconductor industry has received another shakeup with the news that Lattice Semiconductor has been acquired by a Chinese-backed financial group in a deal valued at £1.04 billion inclusive of debt.

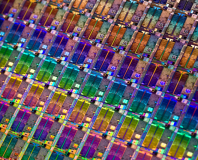

Founded in 1983 and floated on the stock exchange in 1989, the Oregon-based Lattice Semiconductor is the third largest field-programmable gate array (FPGA) designer and second-largest complex programmable logic device (CPLD) and simple programmable logic device (SPLD) designer in the world. Its designs can be found in everything from laptops to networking hardware and TV sets, with revenue hovering around the $300 million mark annually.

Now, though, the company is under private ownership for the first time since its 1989 flotation on the NASDAQ. Canyon Bridge Capital Partners, an investment group backed by Chinese funding, has announced the acquisition of all shares in a deal worth £1.04 billion inclusive of debt, representing a 30 percent premium over the shares' previous valuation.

'We are pleased to announce the transaction today with Canyon Bridge, which will unlock tremendous value for shareholders. This transaction is the culmination of an extensive review process with our Board, financial and legal advisers, and it delivers certain and immediate cash value to shareholders while reducing our execution risk,' claimed Lattice president and chief executive Darin Billerbeck of the agreement. 'We are excited to leverage Canyon Bridge’s resources and market connections as we enhance our focus on executing our long-term strategic plan of continued innovation. Importantly, we will operate as a standalone subsidiary after the acquisition and do not expect any changes in our operations or our unwavering commitment to continued innovation for our customers.'

The deal marks a rather more pleasing interaction with China than experienced by Lattice in 2004, when the company settled a legal case with the United States government over claims it had exported embargoed technologies to China, resulting in a $560,000 fine. It also continues a string of billion-dollar acquisitions in the semiconductor industry over the last year, including but not limited to Broadcom buying Brocade for £4.74 billion, Qualcomm's purchase of NXP Semiconductor for £38.62 billion, SoftBank's acquisition of ARM for £24.3 billion, Microchip buying Atmel for £2.86 billion, Intel picking up Altera for £13.43 billion, and Western Digital snagging SanDisk for £15.27 billion.

Lattice is expected to remain headquartered in Portland, Oregon, with no reported change to operations or staffing as a result of the acquisition.

Founded in 1983 and floated on the stock exchange in 1989, the Oregon-based Lattice Semiconductor is the third largest field-programmable gate array (FPGA) designer and second-largest complex programmable logic device (CPLD) and simple programmable logic device (SPLD) designer in the world. Its designs can be found in everything from laptops to networking hardware and TV sets, with revenue hovering around the $300 million mark annually.

Now, though, the company is under private ownership for the first time since its 1989 flotation on the NASDAQ. Canyon Bridge Capital Partners, an investment group backed by Chinese funding, has announced the acquisition of all shares in a deal worth £1.04 billion inclusive of debt, representing a 30 percent premium over the shares' previous valuation.

'We are pleased to announce the transaction today with Canyon Bridge, which will unlock tremendous value for shareholders. This transaction is the culmination of an extensive review process with our Board, financial and legal advisers, and it delivers certain and immediate cash value to shareholders while reducing our execution risk,' claimed Lattice president and chief executive Darin Billerbeck of the agreement. 'We are excited to leverage Canyon Bridge’s resources and market connections as we enhance our focus on executing our long-term strategic plan of continued innovation. Importantly, we will operate as a standalone subsidiary after the acquisition and do not expect any changes in our operations or our unwavering commitment to continued innovation for our customers.'

The deal marks a rather more pleasing interaction with China than experienced by Lattice in 2004, when the company settled a legal case with the United States government over claims it had exported embargoed technologies to China, resulting in a $560,000 fine. It also continues a string of billion-dollar acquisitions in the semiconductor industry over the last year, including but not limited to Broadcom buying Brocade for £4.74 billion, Qualcomm's purchase of NXP Semiconductor for £38.62 billion, SoftBank's acquisition of ARM for £24.3 billion, Microchip buying Atmel for £2.86 billion, Intel picking up Altera for £13.43 billion, and Western Digital snagging SanDisk for £15.27 billion.

Lattice is expected to remain headquartered in Portland, Oregon, with no reported change to operations or staffing as a result of the acquisition.

MSI MPG Velox 100R Chassis Review

October 14 2021 | 15:04

Want to comment? Please log in.